How Delayed Learning about Climate Uncertainty Impacts Decarbonization Investment Strategies

Climate economics

Project goal

Most state-of-the-art climate-economic models assume a frictionless economy as it pertains to greenhouse gas emissions abatement; this is to say, as soon as policymakers spend money on abating fossil fuel emissions, such emissions reductions manifest as soon as the check clears. In the real world, however, the economy possesses significant inertia that slows the deployment of new technologies, including fossil fuel abatement capital stocks, regardless on how much is spent by policymakers. This inertia generally calls for a more agressive near-term financial approach relative to the no intertia case, as there is a (often significant) time lag between spending and abatement. The goal of this project is to augment a model which captures economic inertia with a systematic treatement of climate unceratinty; we hypothesize that the effects of climate risk and economic inertia will compound, resulting in an ambitious, near-term financial strategy if the Paris Agreement temperature targets are to be met.

I am very pleased to have been hired as a short-term consultant at the World Bank Climate Change Group while this work is being completed!

Abstract

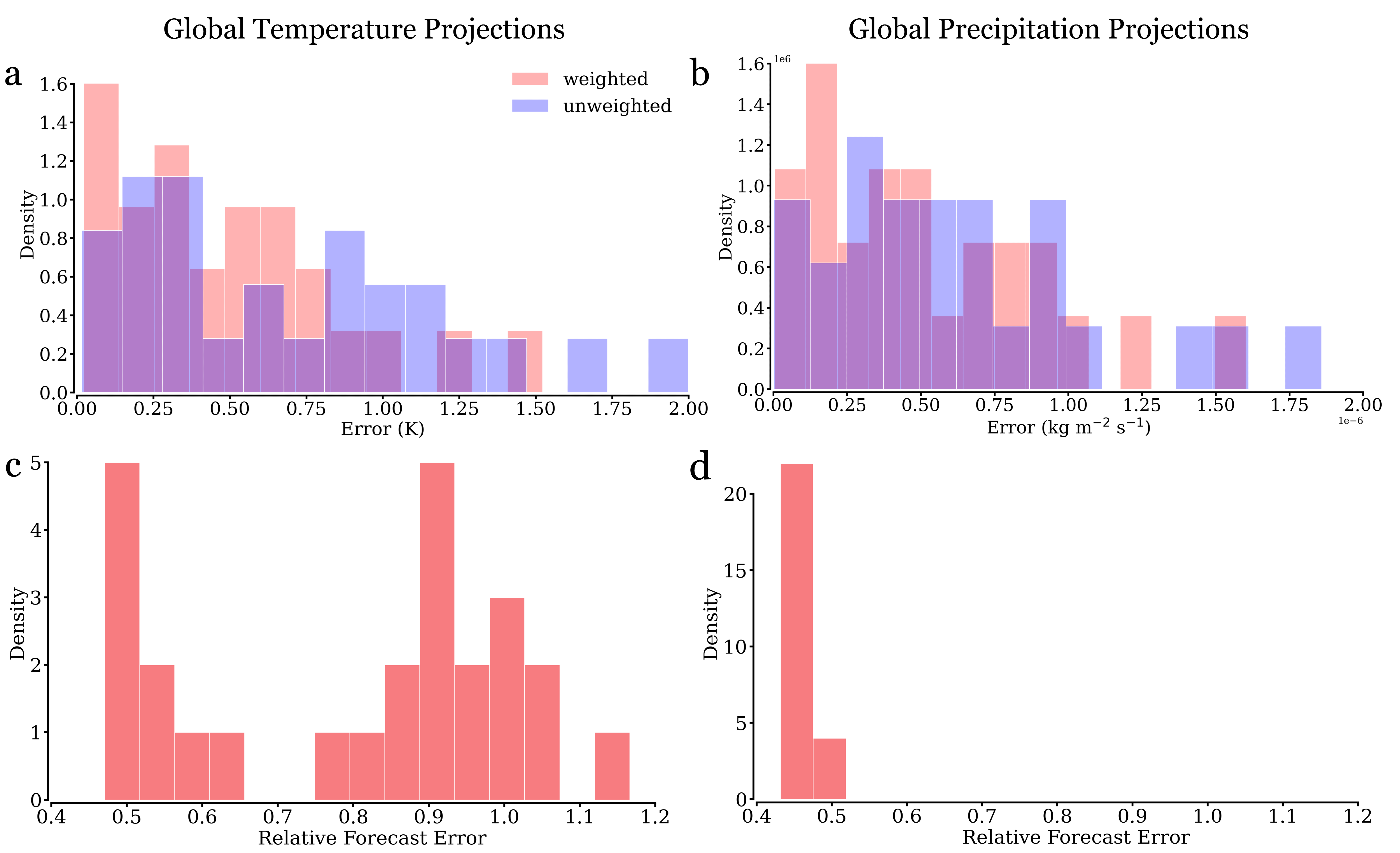

The Paris Agreement established that global warming should be limited to “well below” 2 deg C and encouraged efforts to limit warming to 1.5 deg C. Achieving this goal presents a significant challenge, especially given the presence of (i) economic inertia and adjustment costs, which penalize a swift transition away from fossil fuels, and (ii) climate uncertainty that, for example, hinders the ability to predict the amount of emissions that can be emitted before a given temperature target is passed, which is often referred to as the remaining carbon budget. This paper presents a modeling framework that explores optimal decarbonization investment strategy when both delayed learning about the remaining carbon budget and adjustment costs are present. The findings show that delaying learning about the remaining carbon budget impacts investment in three ways: (i) the cost of policy increases, especially when adjustment costs are present; (ii) abatement investment is front-loaded relative to the certainty policy; and (iii) the sectoral allocation of investment changes to favor declining investment pathways rather than bell-shaped paths. The latter effect is especially pronounced in hard-to-abate sectors, such as heavy industry. Each of the effects can be traced back to the carbon price distribution inheriting a “heavy tail” when the remaining carbon budget is learned later in the century. The paper highlights how climate uncertainty and adjustment costs combined result in a more aggressive least-cost strategy for decarbonization investment.

Working paper and citation

World Bank Policy Research Working Paper No. 10743

Citation: Bauer, A. M., F. McIsaac, S. Hallegatte. How Delayed Learning about Climate Uncertainty Impacts Decarbonization Investment Strategies. World Bank Policy Research Working Paper No. 10743, The World Bank, Washington DC, 2024.

Collaborators

Florent John McIsaac and Stephane Hallegatte.

Project code

All source code for this project can be found on my Github.